mpb.health

Secure

Ideal for self-employed individuals or small

businesses with verifiable 1099 or business ID.

Ideal For One-Person Business

Protection: Small & Large Health Care Expenses

Special Benefits:

Select one of the following Minimum Essential Coverage options:

A. Secure CoPay

B. Secure HSA

Essential Health Care Benefits: Medical Cost Sharing, Telehealth, LifeCare, Concierge Assistance, Cost & Quality Search Assistance, Care Connect

Additional Features: Pharmacy Benefits Program, Personal Medical Records Vault, QR Life Code, WholeHealth Living Choices

You can choose one of the two plan options:

Secure CoPay

Provides preventative and wellness

services as defined in the Affordable Care

Act (ACA). You have access to free

preventative services like:

Annual Wellness Visit

Well-Woman Visit

Childhood Immunizations

Mammograms

Colonoscopies

Primary Care Office Visits

$20 Co-Pay

Unlimited Visits

Specialist Office Visits

$50 Co-Pay

Unlimited Visits

Lab/Blood Work

$10 Co-Pay

Some Limitations

X-rays

$50 Co-Pay

Urgent Care

$50 Co-Pay

Secure HSA

Provides preventative and wellness

services as defined in the Affordable Care

Act (ACA). You have access to free

preventative services like:

- Annual Wellness Visit

- Well-Woman Visit

- Childhood Immunizations

- Mammograms

- Colonoscopies

Health Savings Account Compatible:

A tax-advantage medical savings account that can be used to pay for medical expenses with before-tax dollars is available to taxpayers in the United States who are enrolled in Secure.

- You own the account, therefore, HSA funds stay with you when you change jobs or retire.

- After age 65, HSA funds can be rolled into a retirement account or kept in the HSA for medical expenses

- Money you do not use in your HSA rolls over from year to year and earns interest tax-free.

- Options for self-directed investments can potentially grow your savings for healthcare or retirement.

Medical Cost Sharing

Protection for Large Medical Expenses

Medical Cost Sharing consists of a large community of health-conscious individuals who voluntarily contribute a monthly share amount towards each other’s health care expenses.

3 Simple Responsibility Options:

The Initial Unshareable Amount (IUA) is the personal responsibility of members for their medical Needs. All qualified medical expenses after the IUA is met are shareable with the Medical Cost Sharing community.

$1,000 IUA • $2,500 IUA • $5,000 IUA

Key Features:

- No lifetime or annual caps on qualifying medical expenses

- Empowers and promotes healthy living and lifestyle choices

- Two-year lookback for pre-existing conditions

- Share in medical costs for emergencies or acute care when on vacation or working outside the U.S.

- Maternity Needs are shareable and treated as a medical Need

- If a member dies after one year of uninterrupted membership, financial assistance will be provided to the surviving family

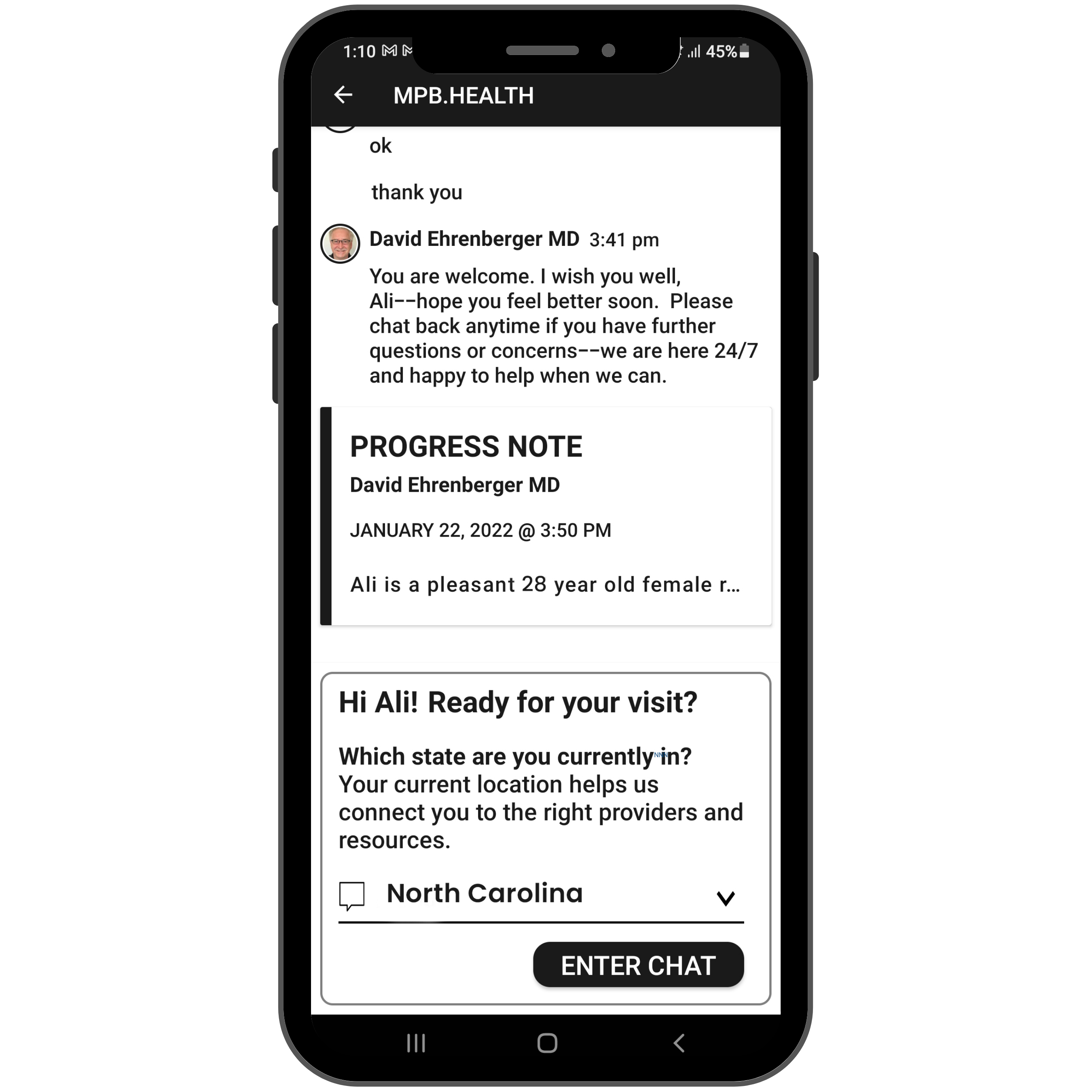

Telehealth

As Easy as Texting a Friend

As a Member, you may access our primary, pediatric, women’s health, and behavioral health board-certified physicians on your own time, whenever and wherever. Through a convenient web and mobile experience, you are free to text directly with our providers to get the answers you need, including access to additional support. This solution will be accessible via secure text (with image share, phone, and video available) 24/7 365 days a year in all 50 states.

LifeCare

Member Assistance Program

100% Confidential Counseling: This program provides members with a way to find help dealing with personal and work-related issues. Without this help, these issues could decrease members’ quality of life or interfere with job performance.

Services Include:

Counseling

Virtual, face-to-face, or telephonic sessions with a counselor

Personal Navigation

In all areas of work/life convenience

Access to Additional Resources

Childcare, legal, financial, support groups, housing, etc.

Elder Care and Financial

Telephonic consulting, tailored eldercare counseling & resources, plus financial wellness counseling provided by experts in their field

Online Training Library

Thousands of virtual work/life training and ability to track progress

Access to Compass

Advanced HR support and assistance in professional development

Concierge Assistance

The concierge is focused on supporting and guiding you every step of the way through your health care journey.

Cost & Quality Search Assistance

Our Concierge Team researches the highest quality, fairest priced providers, diagnostics centers, labs, and medical facilities for members who are in need of these services.

Care connect

For high-cost surgical procedures. We work with the Care Connect Team to search for the highest quality and fairest price for each component of a member’s surgical procedure. The total cost is then negotiated to the lowest possible price.

Pharmacy Benefit Program

Our concierge Team searches a variety of U.S. and worldwide pharmacy discount platforms and pharmacy assistance programs to find the fairest priced medications, as well as where to purchase them.

WholeHealth Living Choices

Your Smart Partner in Solutions for Alternative Medicine

Access to over 35,000 providers, discounts, and more than 35 complementary and alternative medicine specialties.

The WHLC Web portal allows you to print your discount coupons directly without having to wait for an authorization or benefit approval.

Discounts May Include:

Mind & Body

Acupuncture, Chiropractic, Massage Therapy, Natural Healing, Physical and Occupational Therapy and Relaxation

Movement

Accessories and Equipment, Personal Training, Pilates, Tai Chi, Qi Gong, and Yoga

Nutrition

Diet and Nutrition, Food, Vitamins and Prescriptions, and Weight Management

Lifestyle

Dental, Hearing and Vision, Gifts and Special Occasions, Relaxation and Others

QR LifeCode and

Personal Medical Records Vault

Personal Medical Records Vault

You can grant access to your Electronic Medical Records to providers, medical facilities, family, etc., providing continuity of care. Health Tracking provides you and your caregivers the ability to record vital health observations easily and securely.

QR Life Code

In a medical emergency first responders can access your Medical Records Vault through your QR LifeCode Five-digit ID code. You can access and safely share your medical records, track health conditions, and get better healthcare solutions.